There’s no doubt that the number of female-led businesses has risen over the last two decades, including in health tech, and that’s very welcome. But women still get a disproportionately small share of investment, including in the health tech sector. A new report by researcher Ludovica Castiglia and consultancy FemHealth Insights, for instance, has found that female-founded femtech companies in the UK, US and Canada raise 23% less capital per deal compared with male-founded ones. Recent data from the UK government’s Invest in Women Taskforce reveals that women-led companies secured just 1.8% of private equity funding in the first half of this year, down from 2.5% in 2023.

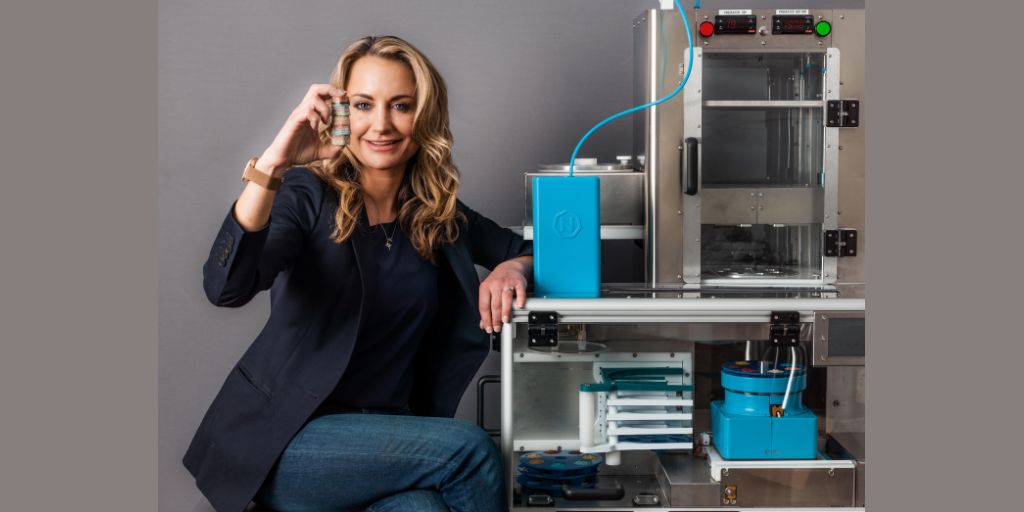

As the creator and CEO of a relatively young, fast-growing health-tech company, I’ve been fortunate to source several million pounds’ worth of investment. I raised the highest female founder seed round in UK history four years ago, for Nourished’s parent company, Rem3dy Health. Partnering with supportive, vision-aligned investors has been instrumental in Nourished – which uses patented 3D-printing technology to create personalised and curated nutrition stacks – expanding across the UK and globally. We now trade online in Japan, the US and in thousands of pharmacies across Europe But not all deserving female entrepreneurs get access to this opportunity. Only around 6% of active equity-backed companies were created by women.

The potential economic impact of addressing this gender disparity is substantial. The Treasury’s Rose Review concluded that ”to £250 billion of new value could be added to the UK economy if women started and scaled new businesses at the same rate as men”. Femtech companies receive just 3% of the total digital health funding in the UK and worldwide. This figure underscores the urgent need for investors, the business community, and female entrepreneurs to take decisive steps to level the playing field and help health tech and other sectors reach their potential.

More government steps needed in the right direction Some state schemes show promise in their aims to support women in launching and growing companies. The Invest in Women Taskforce seeks to establish a private investment pot for female-led firms worth more than £250 million. I was delighted to be announced recently as one of ten inaugural members of the Department for Business & Trade’s (DBT)

Female Founders program. It recognises promising tech businesses, fronted by women, and will give us access to the DBT’s large venture capital investors network. These projects are commendable, but are just a small part of what is needed. £250 million is a fraction of the investment female businesses require. Moreover, the recent decision by Innovate UK – the national agency for supporting tech and other forms of new business – not to continue with a special investment programme for female entrepreneurs feels very short sighted.

To truly move the needle, we need strong government messaging and promotion of the economic benefits of backing female-led businesses, including those innovating around health and tech. Expanding initiatives like the Seed Enterprise Investment Scheme, which offers tax breaks for investments in small start-ups, could provide a crucial boost.

Enhancing Visibility and Networking Opportunities

Female entrepreneurs are usually underrepresented at business and investment conferences, networking events, and on panels. That can be particularly true at technology- oriented events. Event organisers must be proactive in creating more opportunities for women to showcase their businesses and ideas and help them to connect with potential investors. This extends to awards nominations and media coverage. When a journalist is writing a piece about entrepreneurship within a sector, including female founders as much as possible makes us more visible.

The Power of Mentorship and Support Networks

Expanding mentoring programs and support networks for female entrepreneurs is essential. Established female leaders and other business professionals should share their investment knowledge, stories and best practice. Entrepreneurs should build and join support networks – whether that be starting their own female-leader group in their sector or simply joining a local SME group – to get investor contacts and advice.

Initiatives like Women Backing Women and Lifted find female angel investor to fund women-led companies. Lifted’s largest raise, this year, was for a female-led health tech business I’m also proud to work with Buy Women Built, a scheme to encourage and inspire women founders. All are tremendous examples of how business and female entrepreneurs can work together to create change.

Addressing Unconscious Bias in Investment

Overt discrimination against women in business has certainly declined over my career. But unconscious bias and stereotypes do still persist. Investment managers may wrongly assume that women’s ability to overcome entrepreneurial challenges is less than that of men’s. They seem to concentrate more on risks when evaluating female-led businesses, too. There may also be or a lack of understanding regarding the potential or vision of businesses in certain female-orientated sectors, such as tech and other solutions that focus on wellness, beauty or the menopause. Tackling these biases requires comprehensive training throughout the investment sector. Increasing the representation of women in senior leadership roles within the investment community is crucial – only 12% of UK investment trust managers are female.

Crafting Compelling Narratives

Effective investment presentations often rely on storytelling. Female business leaders tend to have compelling personal tales, such as overcoming bias in male-dominated tech sectors or successfully balancing family responsibilities with business growth. These personal narratives can be powerful tools for engaging investors and creating emotional connections.

Emphasising Purpose-Driven Business Models

Businesses that address societal or individual problems often attract investment more readily than those solely focused on profit. Female entrepreneurs frequently bring a strong sense of purpose and empathy to their ventures, such as a new product that will help people overcome a medical condition that has been ignored or underinvested in. This approach is a valuable asset that should be emphasised when seeking investment.

Melissa Snover is CEO and founder of Nourished. It produces 3D-printed personalised- nutrition gummies and a range of tailored nutrition gummies for everything from the menopause to better sleep, immunity, skin health, and child health. For more information, visit https://get-nourished.com/